Once upon a time, we had a pretty good story in play. It went like this: The Fed positions itself relative to this magical variable called r-star. Unfortunately, no one knows exactly where r-star is, but we can come up with a reasonable range of its values. And as policy rates entered into the lower bound of that range, future changes in policy will become more data dependent. Absent any evident inflationary pressure, the Fed could move more cautiously, assessing the data carefully before tightening further.

It was a good story, and it worked. But then New York Federal Reserve President John Williams blew up that story by downplaying the importance of r-star. This was apparently out of fear that market participants would assume an imminent pause was pre-ordained. The focus shifted away from neutral to talk of going above neutral. Forward guidance was ditched in favor of a focus on the Fed’s forecasts which confirmed the intention of going beyond neutral.

Of course, the forecasts were never supposed to be policy written in stone. But, realistically, the Fed’s forecast-based approach made it appear that the path of rates was not particularly data-dependent. I think, more accurately, that when central bankers started talking about going beyond neutral, they were really getting ahead of the data.

Then equity markets stumbled, oil fell, and the dollar rose. Fed officials apparently feared they had set in motion another Taper Tantrum or, almost worse, another 2015-16 episode. They then shifted the discussion back to r-star with Federal Reserve Chair Jerome Powell noting that policy rates would soon be at the lower end of the range of neutral estimates, basically returning to the story that existed before Williams blew it up.

Like I said, I thought it was a good story. I still do. I like it. It was limited forward guidance; a broad range of potential outcomes, but with some structure. The Fed could basically flatten the yield curve, and then if further rate hikes were appropriate, shift the yield curve up. The long bond even lifted off its perch at 3.0%, giving the Fed some breathing room.

But going backwards is not so easy. Because going backwards kind of looks like panicking. And now you look like you are panicking yet still planning to raise rates in December! Seriously, if it was so important to turn the story around, why are we still talking about December? How do you spell P-O-L-I-C-Y E-R-R-O-R?

With that kind of messaging it makes sense to buy into the belly of the yield curve, which is what market participants have been doing in earnest, generating a messy outcome. The yield curve inverted between the 5 and 3 year treasury rate. Ever so slight an inversion, but an inversion nonetheless:

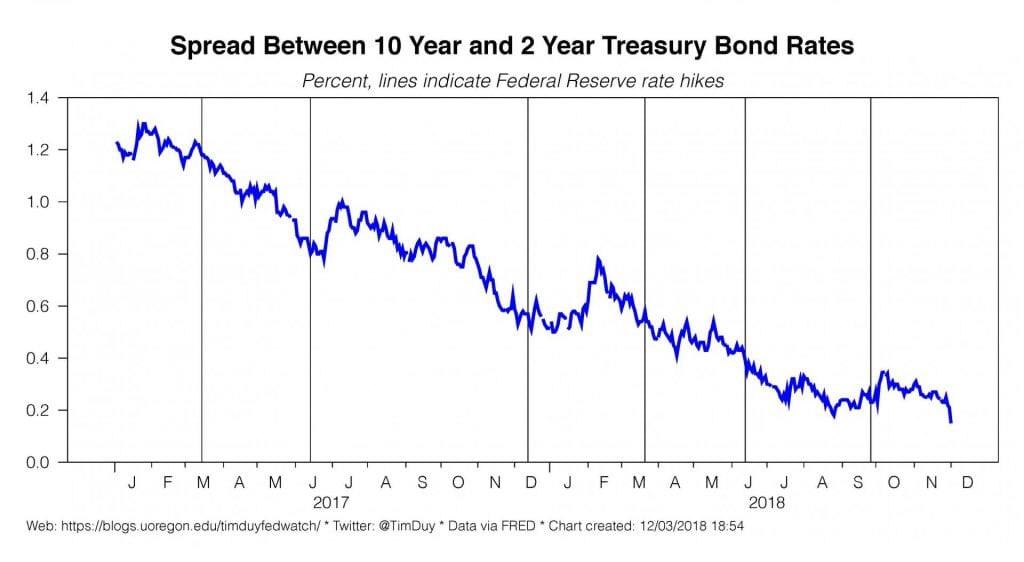

And the 10-2 spread sank closer to inversion:

It is generally thought the 10-2 inversion that is the long-leading indicator of recession, but I would add only if the Fed keeps hiking after the inversion. But we can worry about that later. For now, the 5-3 inversion is messy enough because it will raise additional concerns about December. So now it has the potential to be a nasty little cycle – the Fed backtracks, causing fear of a worsening economy, which inverts part of the yield curve, which raises further concerns about the economy, etc., etc.

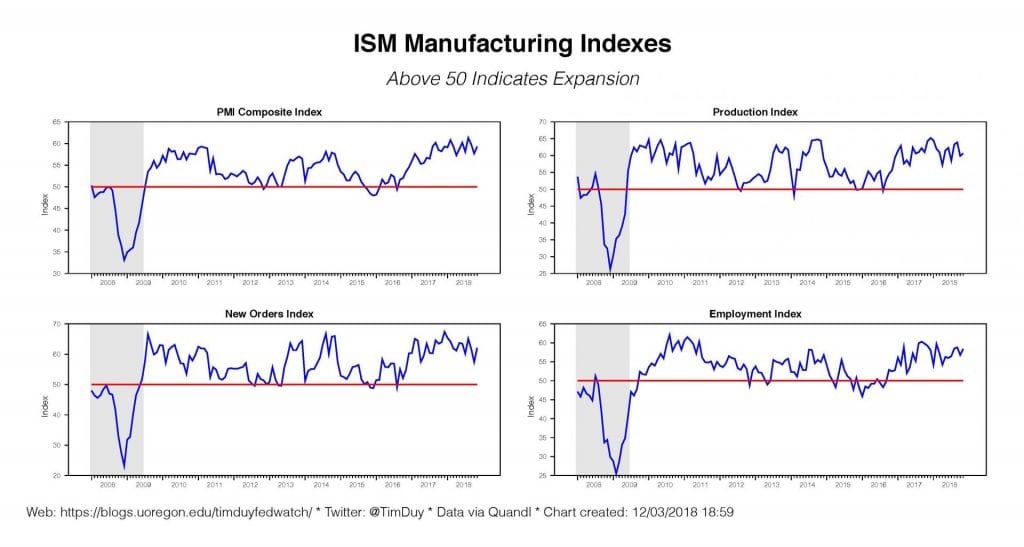

Meanwhile, the data has drifted into the background. Yet that should still be relevant to the Fed. Notably, the ISM manufacturing report was a notch better than expected and holding in a range that one of my readers described as an “early cycle” print:

Except now we are much later in the cycle with a 3.7% unemployment rate. I have a hard time imagining that the economy started falling apart in the final quarter of 2018 yet left the manufacturing sector unscathed. I feel like the Fed’s dovish shift maybe got ahead of the data just as the hawkish shift got ahead of the data. Or the Fed’s dovish shift is already behind the data. Like I said, it’s complicated. We just don’t know what will be left after the sugar high of fiscal stimulus wears off. Nor do I think we should discount the possibility that under divided government, more spending is the path of least resistance.

Bottom Line: In my opinion, I think we focus on the data and the Fed’s basic forecast in the context of a policy rate that is entering into the neutral zone. The strong ISM report suggests that growth is not faltering quickly if at all, which is supportive of the Fed’s current expected path. But inflation remains tame, even softening, which suggests a more dovish path. A little give, a little take. It’s a long time to the March meeting, the next likely opportunity to hike rates under the gradual rate hike regime. Much can happen between now and then. If the data continue to suggest that the pace of activity is likely to place downward pressure on the unemployment rate, they will hike deeper into the neutral range before pausing.