The April employment report hammered down the last nail in the coffin that is the June rate hike. It is virtually inconceivable that the Fed would skip a rate hike this month; only a financial meltdown would stay their hands at this point. And they won’t stop with this next hike. Given the path the economy currently follows, they will continue to hike rates up to neutral before they become willing to slow the pace of tightening.

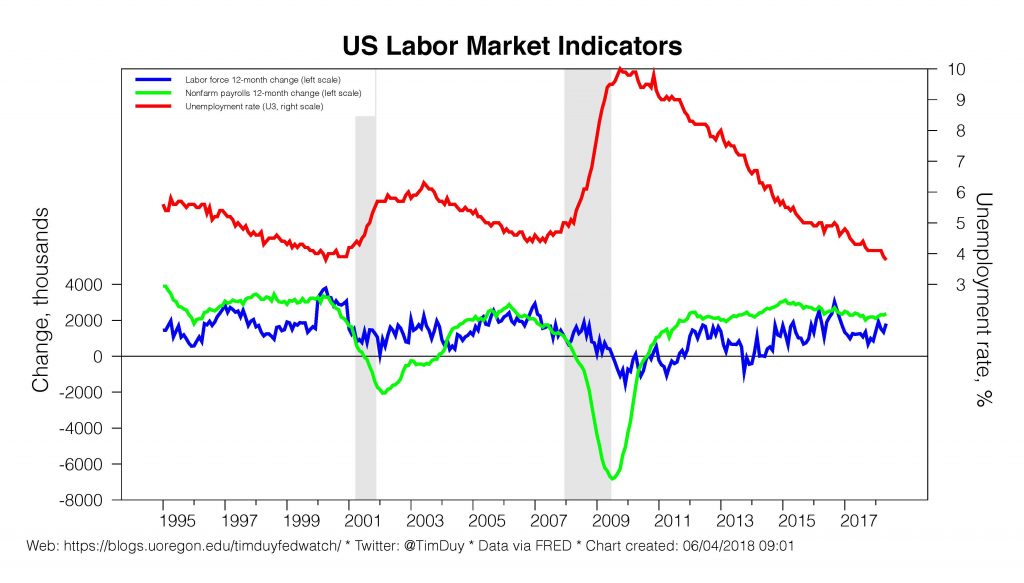

Nonfarm payrolls grew by 223k in May, outpacing consensus of 190k. Despite concerns that the economy runs short of workers, the labor numbers can still eek out job growth in excess of 200k. Over the past three and twelve months job growth has averaged 179k and 197k, respectively. This pace of growth promises to place downward pressure on the unemployment rate. For all of the excitement caused by non-reversing recent gains in prime age labor force participation, overall participation has remained fairly steady just south of 63%. The Fed does not expect it to head higher, believing the opposite more likely as demographic factors kick in into gear and dominate cyclical forces. Policymakers expect something closer to 100k job growth will eventually suffice to hold the unemployment rate steady.

This pace of growth promises to place downward pressure on the unemployment rate. For all of the excitement caused by non-reversing recent gains in prime age labor force participation, overall participation has remained fairly steady just south of 63%. The Fed does not expect it to head higher, believing the opposite more likely as demographic factors kick in into gear and dominate cyclical forces. Policymakers expect something closer to 100k job growth will eventually suffice to hold the unemployment rate steady.

Hence, the Fed fears that sustained job growth at this pace would eventually generate an overheated economy. At 3.8%, unemployment stands at the lowest since 2000. Moreover, most measures of underemployment continue to improve and approach levels not seen since the peak of the last cycle. And further improvement is likely. At a 3.7% rate, which is almost a certainty at this point, unemployment will be the lowest since the 3.5% of December 1969. Arguably, for all intents and purposes the Fed is now in uncharted territory.

It is of course tempting to see the rapid rise of inflation in the late 1960s as the lesson learned from that era. Still, given structural changes in the economy, in particular labor’s lack of bargaining power, it is unclear how that lesson applies now. Indeed, weak wage growth casts doubt on a repeat of the 1960’s anytime soon.

Looking through the monthly ups and downs, the underlying wage growth trend still looks like something close to 2.7%, a fairly anemic pace if inflation sustainably holds at something closer to 2%. That kind of wage growth doesn’t scream “runaway inflation” (especially given that faster wage growth alone does not necessarily transfer into inflation). This will keep the Fed thinking that their estimates of the natural rate of unemployment, currently centered on 4.5%, remain too high. Still, even if their estimate of the natural rate is too high, there almost certainly has to be a point when unemployment falls sufficiently low that behavior shifts to foster more aggressive wage growth. Or perhaps their estimate is correct and the wage response is just lagging the rest of the labor market. And once behavior on wages shifts, perhaps the same will occur for inflation? These concerns nag at central bankers and will only intensify as unemployment drops lower.

Still, even if their estimate of the natural rate is too high, there almost certainly has to be a point when unemployment falls sufficiently low that behavior shifts to foster more aggressive wage growth. Or perhaps their estimate is correct and the wage response is just lagging the rest of the labor market. And once behavior on wages shifts, perhaps the same will occur for inflation? These concerns nag at central bankers and will only intensify as unemployment drops lower.

Altogether, this drives policymakers to keep pushing up policy rates, wanting to at least reach neutral lest they be far away from neutral should inflation actually accelerate more aggressively. This is the message we will continue to hear from central bankers. How many more hikes will that be? Last week outgoing San Francisco Federal Reserve President and incoming New York Federal Reserve President John Williams told Reuters that policy would reach neutral with three more rate hikes. This largely coincides with my view of the likely path of monetary policy. Two hikes are a given to get the policy rate to the lower bound of neutral estimates, but considering the current pace of activity, I expect the Fed to deliver a bit more with another three hikes this year.

Bottom Line: The employment report indicates the economy retains sufficient underlying strength to justify continued Fed rate hikes. The next will come on June 13. I think a rate hike in September is almost a lock as well; the data is not likely to turn around by then. That leaves a December rate hike still arguably up in the air, but I still believe the economy will retain sufficient momentum to coax the Fed into acting for a fourth time this year and push policy deeper into the current range of neutral estimates.