The written testimony accompanying Federal Reserve Chairman Jerome Powell’s visits to Capitol Hill last week left me with more questions than answers. It seems evident that central bankers expect they will need to boost their estimates of appropriate rate hikes either in March of June. It also appears that they would like to make this shift while remaining within the context of the existing policy language of gradualism.

That is a tricky needle to thread, and I understand the motivation. Policy makers simply do not want to spark a sell-off in Treasuries. But the past week has left me wondering if the Fed’s affection for gradualism has left us too complacent about the possibility of a rapid shift away from gradualism. I have lots of questions:

Continued here as a newsletter…

What is the current status of the business cycle? The Fed’s description of its policy objectives made a little noticed transition in testimony over the past six months from “achieve” full employment to “sustain” full employment to “avoiding overheating.” I interpret that as an evolution from a mid-stage to a mature-stage to a late-stage in the cycle.

The late-stage arguably poses the most challenging for policy makers. In the late-stage of the cycle, the pace of activity needs to ease lest the economy overheat and inflationary pressures emerge. Central bankers will thus be under pressure to tighten policy more quickly but fear too much tightening will kill the expansion. In my mind, this stage requires a nimble policy stance, maybe raising rates more quickly with the expectation they may have to be cut more quickly. Such a policy stance, however, would induce uncertainty into financial markets, which the Fed tries to avoid. In an attempt to reduce that uncertainty, they have tethered themselves to gradualism.

What is the definition of “gradual”? New York Federal Reserve President William Dudley placed some boundaries on that concept last week, seeming to say that four hikes would still be gradual while the eight annual hikes of past cycles were the alternative to gradual.

There is a lot of space between four and eight hikes. Does Dudley believe seven hikes this year is gradual? I think that market participants would disagree and, for example, see five hikes as the alternative to gradual. Moreover, there is a case that “gradual” should be based on the expected endpoint, the neutral rate. If so, then with the neutral rate lower now than in past cycles, the Fed may be tightening policy at roughly the same pace as those cycles even though the actual hikes occur more slowly. And by that logic, maybe a shift from three to four rate hikes is a meaningful acceleration because the Fed is closing the gap to neutral more quickly.

Does the Fed expect to increase in the pace of rate hikes to reduce financial accommodation? On first glance, this may seem a silly question. Of course! Why else would they raise rates? Maybe though they just intend to chase the neutral rate higher. In other words, they sense the neutral rate is drifting higher than anticipated, and they need to adjust policy accordingly to maintain constant financial accommodation.

Alternatively, they may believe the real rate is holding steady, but economic tailwinds require additional rate hikes to reduce accommodation. There is also the possibility that both the natural rate is drifting up and economic tailwinds necessitate that the Fed reduces financial accommodation. This requires then an even greater rise in the expected rate path.

Which is it? Is raising the expected policy path to compensate for both a need to tighten and a higher neutral rate is a gradual path? The answer guides us on the type of interest rate environment to expect – a steady to steepening curve versus flattening. From my perspective, I don’t see how you can respond to prospects of overheating with just chasing the long end of the yield curve. It has to be something more.

What’s up with the Fed’s forecasts? Currently, the unemployment rate is 4.1 percent. The decline in 2017 was 0.7 percentage points. The Fed expects growth this year equivalent to last’s but only a 0.2 percentage point decline in the unemployment rate. That just doesn’t add up. And that was before the additional fiscal spending was added to the outlook. But the Fed would have a hard time forecasting another 0.7 percentage point drop this year in the unemployment rate without changing the interest rate and inflation forecasts accordingly. That or a very sharp and arguably questionable reduction in the estimate of the longer-run unemployment rate.

Yes, growth in the labor force or productivity may come to the rescue. But I think it more likely that the unemployment rate makes a sharp drop downward. Job growth has remained well above labor force growth in recent months; it is already somewhat surprising then that unemployment has held steady over that time.

Hence, I see a high risk that the unemployment rate drops to a very uncomfortable level for the Fed when they are already focused on avoiding overheating. At that point, I am guessing they will evolve again from “avoiding” to “responding to” overheating.

What is the realistically acceptable lower bound for unemployment? When do officials become very uncomfortable? The median unemployment rate forecast for the end of this year and next is 3.9 percent. The low of the central tendency of projections is 3.6 percent for 2019. Powell said the longer-run rate of unemployment may be as low as 3.5 percent.

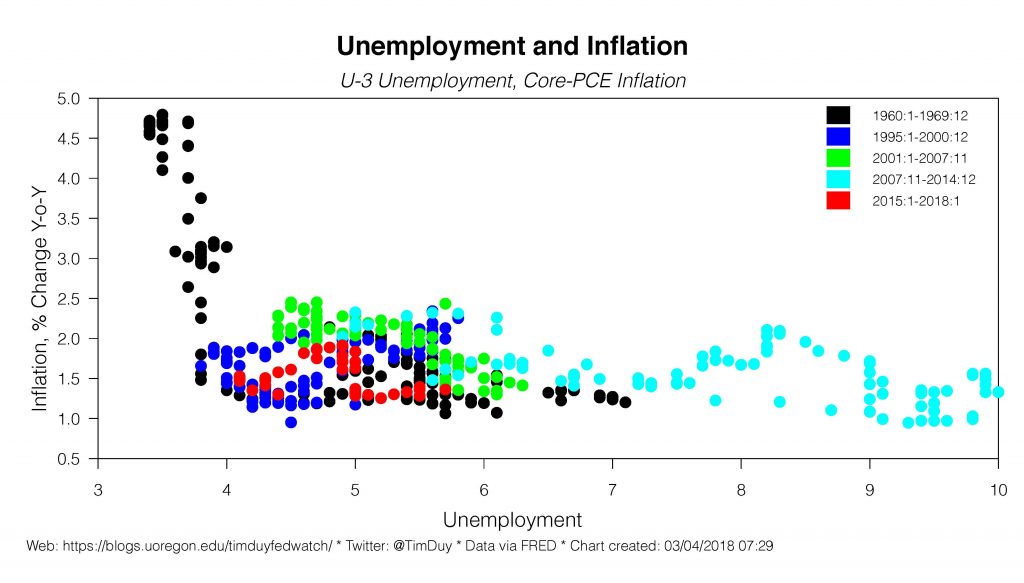

The problem with all of these forecast is that all intents and purposes, a sustained unemployment rate much below 4 percent is basically uncharted territory. The last time the economy sustained such a low level was the late-1960s.

The late-1960s analogy is very interesting. Much has been written of the flat Phillips curve; for more than 20 years inflation concerns have proven overblown. Funny thing though – the Phillips curve was flat for much of the 1960’s as well. Right up until the end of the decade, when inflation quickly emerged – during a sustained period of below 4 percent unemployment. Fiscal stimulus came into play at that time as well. From the 1968 Economic Report of the President:

Nevertheless, the fuller use of resources posed new problems of diagnosis and policy application. Previously, the risks had been almost entirely on the side of insufficient demand; and the primary task of policy had been to provide stimulus. As the unemployment rate fell toward 4 percent, the economy entered territory that had been uninhabited for nearly a decade. There were now risks on both sides—not only of inadequate but of excessive stimulus.

This warning was probably too late by 1968. With such history, and given the likely direction of risk to the forecast, I think it completely reasonable that central bankers would shift the goalposts to avoiding overheating. But that requires them to own a stronger view on the reasonable boundary for unemployment.

Bottom Line: If I step back and take a dispassionate view of the situation, I see where Powell & Co. would need to shift gears in the near future. Somewhere around 4 percent unemployment seems to be a sweet spot for the economy. I would want to stay here as long as possible; that seems safest if one wants to avoid overheating yet still keep sustained pressure on the job market. We might be able to push lower, but the territory is uncharted. Here be dragons? But the Fed’s forecast was at risk of blowing past this level even before the extent of the fiscal stimulus became evident. In other words, the gradual pace of tightening may have been too gradual. That is not a criticism as much as an observation; I have long argued that the Fed should push boundaries in this expansion. That said, this was with the expectation that the Fed would quickly shift gears and abandon gradualism when needed. It might take some nimbleness on the part of the Fed to hold the economy steady. Hence, the Fed’s communication emphasis on gradualism – to the point that seemingly anything less than eight hikes a year is gradual – may be lulling market participants into complacency when no such complacency is warranted. The situation may change quickly.