Well, that was unpleasant. But not completely unexpected.

Continued here as a newsletter…

I don’t think it is possible to examine Monday’s action on Wall Street without the context of the last few months of rapid and virtually uninterrupted gains. Equity prices were easily outpacing historical gains during tightening cycles. And we even lacked the productivity story of the late 1990’s that helped drive gains during that period. In short, markets felt frothy. A correction was waiting to happen.

As far as the exact cause is concerned for why the correction occurred Monday, there probably isn’t one. Leadership change at the Fed? Unexpectedly high wage growth? Political uncertainty? Perhaps none, or perhaps all contributed to the psychological shift that drove Monday’s wave of selling.

What I am fairly confident about is that the sell-off is more about correction for an overly fast pace of gains than a sign that the economy will likely turn the corner. Nor do I think the sell-off is of a magnitude that would materially change the outlook for the economy or monetary policy. This I think will be the message from Fed officials.

My baseline scenario is this: The January employment report suggests that the economy is operating close to or beyond full employment. Moreover, incoming data such as the recent ISM reports on the manufacturing and service sectors are consistent with an economy that maintains solid cyclical momentum. That momentum will receive an additional boost from tax cuts.

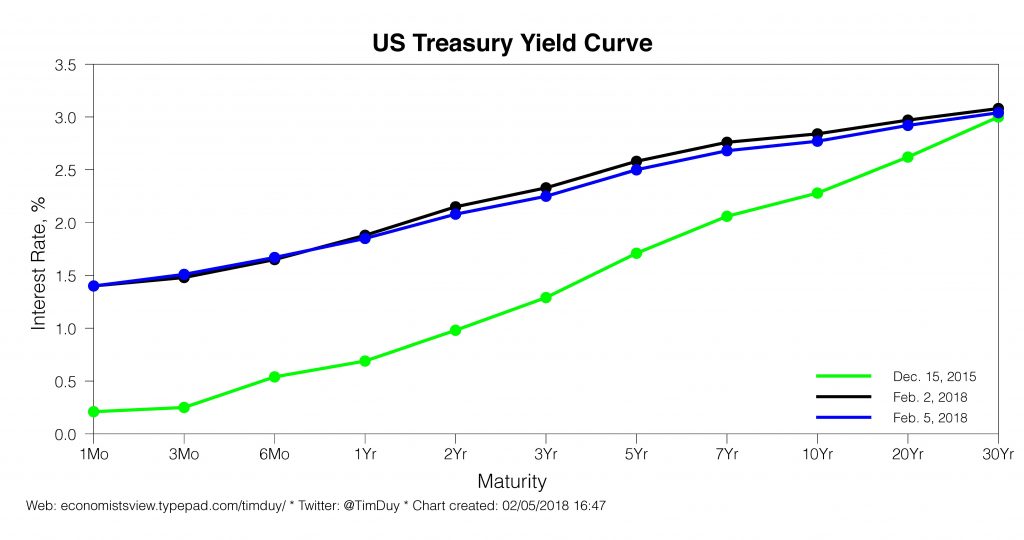

The implication for monetary policy is that the Fed is most likely to continue to raise interest rates. In the absence of deeper market declines, or the revelation that the declines are triggering systemic damage via leverage within the financial sector, the Fed will I suspect welcome the recent market declines. Taking the froth out of the markets early helps sustain the expansion will be the thinking. First, there is less likelihood the excess on Wall Street will spill over into Main Street as in the last two cycles. Second, policy makers will feel less pressure to raise rates to rein in financial markets. They can hold their attention to where it should be, the dual mandate.

A less ebullient equity market will thus help reduce the risk of a fourth rate hike this year. That fourth hike now seems “less compelling.” That said, I still don’t believe equity prices would have been the driving factor in any event. The aggressiveness of the Federal Reserve this year will depend more on inflation outlook. The Fed will tolerate higher wage growth; what they won’t tolerate is a forecast of persistent inflation in excess of their target.

Of course, getting policy right is easier said than done. The challenge facing newly minted Federal Reserve Chair Jerome Powell is navigating policy during a mature phase of the business cycle. Powell faces a mature economy that is closer to full employment than arguably any time since the last 90s. That is usually close to the tipping point in the business cycle. Typically, the Fed needs to continue to tighten policy to prevent overheating of the economy, but it is easy to over tighten and tip the economy into recession. Powell’s challenge will be to both keep snugging up on policy while both resisting calls to accelerate rate hikes late in the cycle and knowing when enough is enough – when to pull back from tightening. The last point is probably the most difficult due to lags in the policy process.

This is a challenging position for any Fed chair.

Bottom Line: Don’t panic just yet. Market declines do not appear tied to an earnings warning or recession threat (like 2015/206) nor are they sufficient to derail the expansion. In fact, you can argue that at this point they lengthen the expansion. What does it mean for monetary policy? It’s not a fun day to start his tenure leading the Fed, but it is still too early for Powell to be thinking about implementing the “Greenspan put.” Way too early. Fed officials will tell you they are watching financial markets but that the economic data still guides their policy decisions. Take them at their word. We need a couple of more days like this to change that story.