By: Peter Blair

Introduction

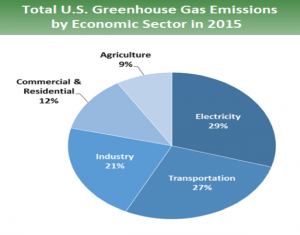

It’s no secret that electricity makes the world-go-round. We use it to accomplish basically everything, from charging our phones, powering production, to heating our homes. Electricity has become essential for modern life. This is especially true in the United States where, according to the Lawrence Livermore National Laboratory, electricity generation accounts for 37.5 quads[1] of the 97.3 quads of energy consumed annually.[2] Electric generation, while essential to fueling our daily lives and the modern economy, can be a large producer of greenhouse gases and thus a contributor to climate change. You can see the breakdown of American greenhouse gas emissions below.[3]

As we move towards a more environmentally responsible future, it is clear that changes need to be made to our current electric system – mainly cutting carbon out of the equation. Previously, states have implemented innovative regulatory programs which foster renewable energy integration, demand side management programs and more. But are these even necessary? Could we simply finance a green future by allowing utilities to recover costs for cutting carbon?

Electrifying America: The History of Electric Regulation

One of the key factors in creating the “American Century[4],” was electricity.[5] America electrified at an extraordinary rate. The American economy and quality of life became entangled with electricity. This however, was no coincidence – it was a calculated decision by the federal government.

In the early days of electricity the cards were stacked against investment.. There was no infrastructure, so not only did power producers need to entice capital to build power plants, but they also needed money to build transmission lines, substations, interconnections and everything in-between. This was a capital-intensive undertaking, yet many small companies attempted to enter the market. Initially, electricity function like most American industries – in an open free market subject only to the constraints of supply and demand. However, this system of open market competition was highly inefficient with massive amounts of money being spent on building exclusive transmission lines, and minimal electricity generation due to small facilities. With each company owning exclusive transmission lines to service its customers, massive duplication of infrastructure resulted. The wastefulness of this system can be seen from the makeup of New York City in the late 19th century and early 20th century where large demand called for increased generation. However, due to high competition each company could only build a small generation facility and was forced to create individual transmission lines for exclusive use. The result is a sky riddled with transmission lines.[6][7]

Not only was this system aesthetically unappealing, but it was also ineffective in terms of utilizing capital in an efficient way or in quickly electrifying the nation. Power production requires massive capital investment. Having multiple small power producers fight over the same territory and build independent transmission infrastructure would not see electricity expand at the rate the government wanted. Thus, the government decided to look at the electricity industry in another light, as a natural monopoly.

A natural monopoly is a monopoly in an industry in which it is most efficient (involving the lowest long-run average cost) for production to be permanently concentrated in a single business rather than contested competitively in the open market. Under a natural monopoly theory, one business, generally the largest supplier in an industry, gets an overwhelming cost advantage over other actual and potential competitors, so a natural monopoly situation generally leads to an actual monopoly. Natural monopolies tend to involve industries where capital costs predominate, creating economies of scale that are large in relation to the size of the market, and hence creating high barriers to entry. Below is a depiction of the typical natural monopoly framework.

This resulted in utilities being governed under what has been called the regulatory compact.[8] Under this regulatory scheme, the utility agrees to accept an obligation to provide its service territory with affordable and reliable energy.[9] The government, in exchange for this service, agrees to grant the utility a monopoly designation, with a promise of a reasonable return on investments to ensure the utility can continue to gain revenue to entice capital and therefore continue to operate and grow.[10] This became the basis of the American electric regulation.[11] One large monopoly in a given area supplying customers and the public with electricity, in exchange for government mandated return on investments.

This regulation theory comes to fruition in the ratemaking mechanisms of state public utility commissions.[12] The federal government has charged the states with setting rates for utilities in its jurisdiction.[13] The rates must serve four key functions: (1) enticing capital to keep the utility operational and functional, (2) ensuring reasonably priced energy for consumers, (3) promoting rates at the efficient price which it would be in a hypothetical market, and (4) maintaining profit control.[14] These four key functions are embedded in the ratemaking formula:

- Rate per KWh = (Operating Expenses + Rate Base) x Rate of Return

-

- Operating expenses are things like fuel, wages, materials, supplies, payments to vendors, taxes

-

- The rate base is the value of the utility’s property lessdepreciation. The rate base is the total of all long-lived investments made by the utility to serve consumers, net of accumulated depreciation. It includes buildings, power plants, fleet vehicles, office furniture, poles, wires, transformers, pipes, computers, and computer software.

- The rate of return is set by the state Public Utility Commissions (or other governing body) and must be just and reasonable and must be offered to attract capital investments

The rate base is particularly relevant in terms of paying for carbon reductions. The ratemaking system has been understood for years as a barrier to carbon reductions in electric generation. This is because of the throughput incentive. The throughput incentive is the concept that based on the ratemaking structure utilities have an incentive and right to promote sales growth to recover on capital investments, which is generated when the fixed rates the government sets are recovered through volumetric sales of energy to consumers.[15] In other words, more money spent more money gained.

- Expanding the Rate Base to Allow Utilities to Recover for Cutting Carbon

If the rate base consists of all capital expenditures that are recoverable couldn’t we just allow them to include investments to cut carbon in the rate base? While this seems like a straightforward idea, it actually has underlying complexities.

Energy Efficiency: Uncertainty and Fluctuations

Energy Efficiency is considered by many to be the first renewable. It is often lower cost, saves energy which in turns saves on emissions, and can be used to cut down on peak demands.[16] However utilities under the traditional cost recovery system do not actively seek to implement energy efficiency programs because of the throughput incentive. There appears to be an easy fix to alleviate the burden of the throughput method: allow utilities to recover thos cost of energy efficiency projects through ratemaking. This idea would see costs spent on energy efficiency projects recoverable through rates just as other capital-intense projects are. Therefore, the utilities, while still providing energy efficiency which will undermine the total volume of their sales, would still receive compensation through rates.

This solution is complicated for two primary reasons. First, expenses related to energy efficiency often have large yearly fluctuations.[17] This is specifically true for significant projects for industrial or commercial customers. [18] Thus, even if utilities can place energy efficiency projects into rate, they are likely to either over-or-under-recover for these expenses.[19] Second, energy efficiency projects disrupt existing return on capital investments.[20] If a utility invests in energy efficiency, they naturally will sell less units of electricity than projected when they forecasted a previous capital investment.[21] Therefore, the utility will not fully recover its fixed cost of previously built capital expenses. One study estimates that a full-scale energy efficiency program could cut utility earnings by 172 basis points, even while customer benefits totaled $131 million.[22] Moreover, the same study indicated that direct attempts to place energy efficiency into rates have failed.[23] Therefore, allowing utilities to recover costs for energy efficiency project through a rate base is idealistic but highly unlikely.

Large Scale Carbon Neutral Projects

While energy efficiency projects are unlikely to work due to uncertainty and disruption in predetermined investments, allowing utilities to recover for large scale projects which reduce carbon emission may work. We have already witnessed two instances of this approach in New York.

The first example is Con Edison’s Brooklyn-Queens Demand Management Program (BQDM).[24] Con Edison needed to build a new substation in either Queens or Brooklyn to handle increased energy demands in the area. Both Burroughs had seen an increase in population which increased the demand as well as peak demand during the summer months. In place of requesting funds for capital expenditures to construct a $1 billion dollar substation in Brooklyn to meet increasing load demand, ConEd spent $200 million to utilize solar, batteries and energy efficiency solutions and was compensated in the same way a capital expenditure would be. Recognizing that the utility had replaced capital investment with operating expenses to achieve the same goal, the Commission authorized a return on total program expenditures, as well as performance incentives tied to goals on customer savings.

The second instance is also a Con Edison project. Con Edison created a virtual power plant project.[25] The project integrates behind-the-meter solar and storage resources into the distribution grid by aggregating residential installations into a virtual power plant, enabling the utility to harness an intermittent power source to provide distribution and transmission benefits. The project is estimated to cost 15 million and will outfit 300 homes in in Brooklyn and Queens with leased high-efficiency solar panels and lithium-ion battery energy storage systems. Con Ed will initially own the storage systems with the intention of generating 1.8 MW of capacity to serve as a clean virtual power plant. The 15 million will be placed into the rate base and thus recoverable.

While these examples show success in New York, Oregon has a unique problem. Oregon requires integrated resource planning for its investor owned utilities. Through IRP, utilities must plan and forecast proposed energy demands, peaks and needs to future years.[26] The purpose is to ensure that utilities can thoroughly plan to meet projected energy demands for their service territory.[27] Currently 30 states have some form of integrated resource planning.[28] The problem for Oregon is that it has a unique IRP process which may hinder paying utilities to cut carbon.

In 1989, the Oregon Public Utility Commission issued Order 89-507, making Oregon the first state to mandate IRP for utilities.[29] The order requires utilities to undertake a cost-effective planning technique, which mandates that the utility consider both supply and demand-side aspects of meeting future load demands.[30] Most importantly, the order mandates that a utilities must pursue the cheapest available option to meet forecasted demand.[31] Under the Oregon model, a “resource should be deemed cost-effective and thus eligible for selection if its costs are lower than the costs of alternative resources assuming a market in which all costs, including environmental costs, are reflected in resource price tags.”[32]

In 1989, the Oregon Public Utility Commission issued Order 89-507, making Oregon the first state to mandate IRP for utilities.[29] The order requires utilities to undertake a cost-effective planning technique, which mandates that the utility consider both supply and demand-side aspects of meeting future load demands.[30] Most importantly, the order mandates that a utilities must pursue the cheapest available option to meet forecasted demand.[31] Under the Oregon model, a “resource should be deemed cost-effective and thus eligible for selection if its costs are lower than the costs of alternative resources assuming a market in which all costs, including environmental costs, are reflected in resource price tags.”[32]

Since passing Order 89-507, subsequent PUC regulations have updated the IRP process. For instance, Oregon now requires a conservation potential study to be done periodically for each utility’s service territory. This has given rise to strong arguments highlighting the benefits energy efficiency can have in deferring costly transmission and distribution investments.[33] Moreover, new requirements mandate that utilities must include an analysis of the environmental externalities and expected compliance costs of carbon dioxide in reports.[34] Finally, Oregon’s IRP model also requires the utility to meet demand with a focus on risk management. Oregon, unlike any other state, places a strong emphasis on risk management and identification in resource planning.[35] Oregon mandates that “risk and uncertainty must be considered” in resource planning. [36] Risk is defined as a measure of possible negative outcomes associated with the resource plan.[37] Uncertainty is defined as the measure of the quality of information about a specific event or outcome which the plan assumes in assessing options to meet service loads.[38] The Oregon PUC requires that utilities take the identified risks, their probabilities of occurrence, and the likelihood of negative outcomes into their choice of preferred resource plan, while still mandating utilities to pursue the most cost-effective option available.[39] The primary goal of Oregon’s IRP process is therefore the selection of a portfolio of resources with the best combination of expected costs and associated risks and uncertainties for the utility and its customers.”[40] Since Order No. 07-002 specifically requires utilities to consider an analysis of the environmental externalities and expected compliance costs of carbon dioxide in reports, the emphasis on risk and uncertainty has become a major tool in forcing utilities to consider the environment. In terms of risk the rules specify that, at a minimum, the following sources of risk must be considered in utility resource plans: load requirements, hydroelectric generation, plant forced outages, fuel prices, electricity prices, and costs to comply with any regulation of greenhouse gases, as well as any additional sources of risk and uncertainty.

Oregon’s IRP process has been impactful in forcing utilities to consider energy efficiency when meeting future projected load growth. However, it may act as a barrier to allowing large scale projects, such as those in New York, to be undergone by utilities let alone recoverable through the rate base. Since the process requires that any project to meet demand must be both the most cost-effective and lowest risk. While the cost of renewable energy is decreasing dramatically causing renewables to be cost competitive, the risk factor is likely where Oregon would struggle to implement and rate base carbon reducing projects. Renewables still have high risk, they are intermittent and non-dispatchable. To overcome this, storage is an option, but storage is expensive at this point in time.

Conclusion

What appears to be a simple solution to the global crises of climate change turns out to have hidden intricacies and complications. Under the current regulatory model governing ratemaking in Oregon, it is unlikely that large renewable projects can be rate based. While this is unfortunate, it is not likely the end of the story. With the passage of Senate Bill 978, the Oregon Legislature has entrusted the Oregon PUC to create a process under which it will evaluate the current regulatory model governing electric utilities in Oregon, study new technologies, policies and trends occurring in the nation, and attempt to see if Oregon should create a new model or modify its own.[41] Hopefully, this process will create a framework where discussion about inducing carbon cuts in electric generation through cash incentives, but only time will tell.

[1] A quad is a unit of energy equal to a short-scale quadrillion British Thermal Unit (BTU.)

[2] Lawrence Livermore National Laboratory, Estimated U.S. Energy Consumption in 2016. Available at https://flowcharts.llnl.gov/content/assets/images/energy/us/Energy_US_2016.png

[3] Emission Breakdown from EPA. Available at https://www.epa.gov/ghgemissions/sources-greenhouse-gas-emissions

[4] The American Century is a characterization of the period since the middle of the 20th century as being largely dominated by the United States in political, economic, and cultural terms. See, David Harvey, The New Imperialism, (New York, NY: Oxford University Press, 2003)

[5] See, History of Electricity from Institute for Energy Research. Available at https://www.instituteforenergyresearch.org/history-electricity/

[6] Vincze Miklos – Photos from the Days When Thousands of Cables Crowded the Skies

[7] Id.

[8] Lincoln L. Davies, Alexandra B. Klass, Mari M. Osofsky, Joseph P. Tomain, & Elizabeth J. Wilson, Energy Law and Policy (1st ed. 2012). p. 317

[9] Id.

[10] Id.

[11] Id.

[12] Id.

[13] Id.

[14] Id. at 320

[15] Id.

[17] Inara Scott, “Dancing Backward in High Heels”: Examining and Addressing the Disparate Regulatory Treatment of Energy Efficiency and Renewable Resources, 43 Envtl. L. 255, 278 (2013)

[18] Id.

[19] Id.

[20] Id.

[21] Id.

[22] Eric Hirst & Eric Blank, Quantifying Regulatory Disincentives to Utility DSM Programs, 18 Energy 1091, 1101 (1993).

[23] Id. at 1103

[24] Robert Walton, Straight Outta BQDM: Consolidated Edison looks to expand its non-wires approach. Utility Dive. (July 19, 2017). Available at http://www.utilitydive.com/news/straight-outta-bqdm-consolidated-edison-looks-to-expand-its-non-wires-appr/447433/

[25] Peter Maloney, Con Ed rolls out $15M virtual power plant project for REV. Utility Dive (June 16, 2016). Available at http://www.utilitydive.com/news/con-ed-rolls-out-15m-virtual-power-plant-project-for-rev/420832/

[26] Scott F. Bertschi, Integrated Resource Planning and Demand Side Management in Electric Utility Regulation: Public Utility Panacea or a Waste of Energy?, 43 Emory L.J. 815, 829-36 (1994)

[27] Id.

[28] Id.

[29] Public Utility Commission of Oregon. Order No. 89-507. Docket No. UM 180. April 20, 1989

[30] Id.

[31] Id.

[32] Id.

[33] Public Utility Commission of Oregon. Order No. 07-002. Docket No. UM 1056. January 8, 2007.

[34] Id.

[35] Wilson, R., & Biewald, B. (2013, June). Best Practices in Electric Utility Integrated Resource Planning: Examples of State Regulations and Recent Utility Plans. Synapse Energy Economics for The Regulatory Assistance Project. p 16. Available at: http://www.raponline.org/document/download/ id/6608

[36] Public Utility Commission of Oregon. Order No. 07-002. Docket No. UM 1056. January 8, 2007.

[37] Id.

[38] Id.

[39] Id.

[40] Id.

[41] See, OR Senate Bill 978 Available at https://olis.leg.state.or.us/liz/2017R1/Measures/Overview/SB978