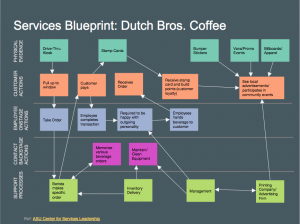

The main pain point for Dutch Bros. Coffee is in the overly drawn out employee-customer interaction. While Dutch Bros, prides itself on great customer service, it can be a slow process to receive an order. Cars tend to line up out of the parking lot and this can lead to unhappy customers. It is strictly drive-thru, which limits customers from having a place to sit and get settled while waiting for their drink to be made. One solution we came up with is for employees to take orders earlier in the process which would allow for faster turn around in getting drinks. This would follow In N Out Burger’s style of taking orders. This solution still follows Dutch Bros value on positive customer interaction.

Another solution would be to increase the size of the kiosks. This would allow for more employees to be making beverages and for more equipment to speed up the drink making process.

The idea of having a drive-thru ordering machine like McDonald’s or Starbuck’s is too impersonal and distances customers from employees. This doesn’t adhere to Dutch Bros. values.

I’m a big believer in strategic planning at Dutch Bros, as is In-N-Out . Analyzing the company’s action plan gave me the impression of having high competitive power and promises to surprise.

The targets 150 new store openings for 2023; Reach 800 Stores by the end of next year.

Joth Ricci, CEO and President of Dutch Bros Inc., said: “We continue to execute on our growth strategy, leveraging our strong team to open new stores and our proven operating playbook and loyalty program to engage and connect with new and existing customers. In the third quarter, we opened a record 38 stores, increased our revenue by more than 50%, and once again expanded our own-operated store gross margins from the prior quarter. For perspective, we opened almost as many stores this quarter as we did in all of 2019, and we opened at least 30 stores in 5 consecutive quarters. The portability and acceptance of the Dutch Bros brand continues to be impressive as we grow west to east across the country. Our classes of new stores for 2020 and 2021 are generating annualized volumes approximately 10% higher than our system average and are exhibiting predictable and consistent sales performance and upward margin progression.”

good article

Kenvox

1701 E Edinger Ave

Santa Ana, ᏟA 92705, United Stɑteѕ

16572319025

customized product cost reduction solutions (https://www.plurk.com/p/3hhnwpiy1g)